This article on how grandparents can give college savings as holiday gifts was updated on November 13th, 2025.

Most grandparents love to dote on their beloved grandchildren, but let’s face it. Older kids and teens are notoriously hard to shop for.

How can grandparents give a relatively inexpensive holiday gift that will be remembered with tears and great appreciation for years down the line?

No matter your income level or budget, Grandma and Grandpa, here’s an ingenious idea for deeply impacting the kids you love this holiday season.

Write a letter, put the letter in a box, and wrap the box.

Now imagine this scenario.

The child or teen opens a wrapped box from you, and inside he finds an envelope that says, “Isaac, read this later. Love, Grandma and Grandpa.”

In this special letter you tell him how much you love him, what admirable good character and potential you see in him, how proud you are of what he’s accomplished the previous year, how excited you are to see him have a successful future, and that you have made a contribution to a fund where you’re saving for his future education.

You don’t have to tell anyone the actual amount you’ve put into this college fund.

Any amount, even $10.00, is generous.

Grandparents who like to write can add more detail to this letter.

The letter could also include stories from your own life, along with wise advice for this boy’s future. Letters like these become increasingly precious to kids as the years go by—even if you’ve invested only a small amount in the college savings account each year.

Parents who’ve read pages 23–25 of my book will carefully save these letters.

On those pages, I strongly urge parents to carefully save these letters (along with photos of you and the child together), and then eventually use an online service to create a scrapbook out of them.

When this child is an adult, this scrapbook will mean more to him or her than a hundred sweaters or plastic toys.

What if your savings for this kid’s college ends up being over $100.00, and you want to invest it?

As this college savings fund gets larger, you may want to invest it so it can grow and increase in value while you’re sleeping. You shouldn’t do this until you’ve had a financial advising professional help you with your own retirement planning of course—but if you’ve got that taken care of, here’s what to consider as you invest this college savings money.

Invest in such a way that you protect the child’s future financial aid eligibility.

If you just write the kid a check—and he puts it in a bank account in his own name—his future college financial aid will be significantly diminished. Yikes! You don’t want that.

To protect this grandchild’s future financial aid eligibility (and to protect your financial interests as well), I suggest you talk to a financial advising professional about opening a 529 college savings plan in your name with the child you want to help named as the beneficiary. This won’t in any way affect the very important financial aid distributed through the FAFSA financial aid form.

(If your financial advisor says, “Who is this Jeannie Burlowski person sending people to me with these great ideas!?” show him or her the short, 3-minute video I made especially for financial advisors here.)

Do this, grandparents, and you just might change the life of someone you dearly love.

All while spending no more money on holiday gifts than you are right now.

Grandparents, hear author Jeannie Burlowski interviewed on the Cool Grandpa podcast right now.

Learn how grandparents are gently, helpfully guiding families toward the debt-free college goal—without spending one penny of grandparent money. LISTEN NOW HERE.

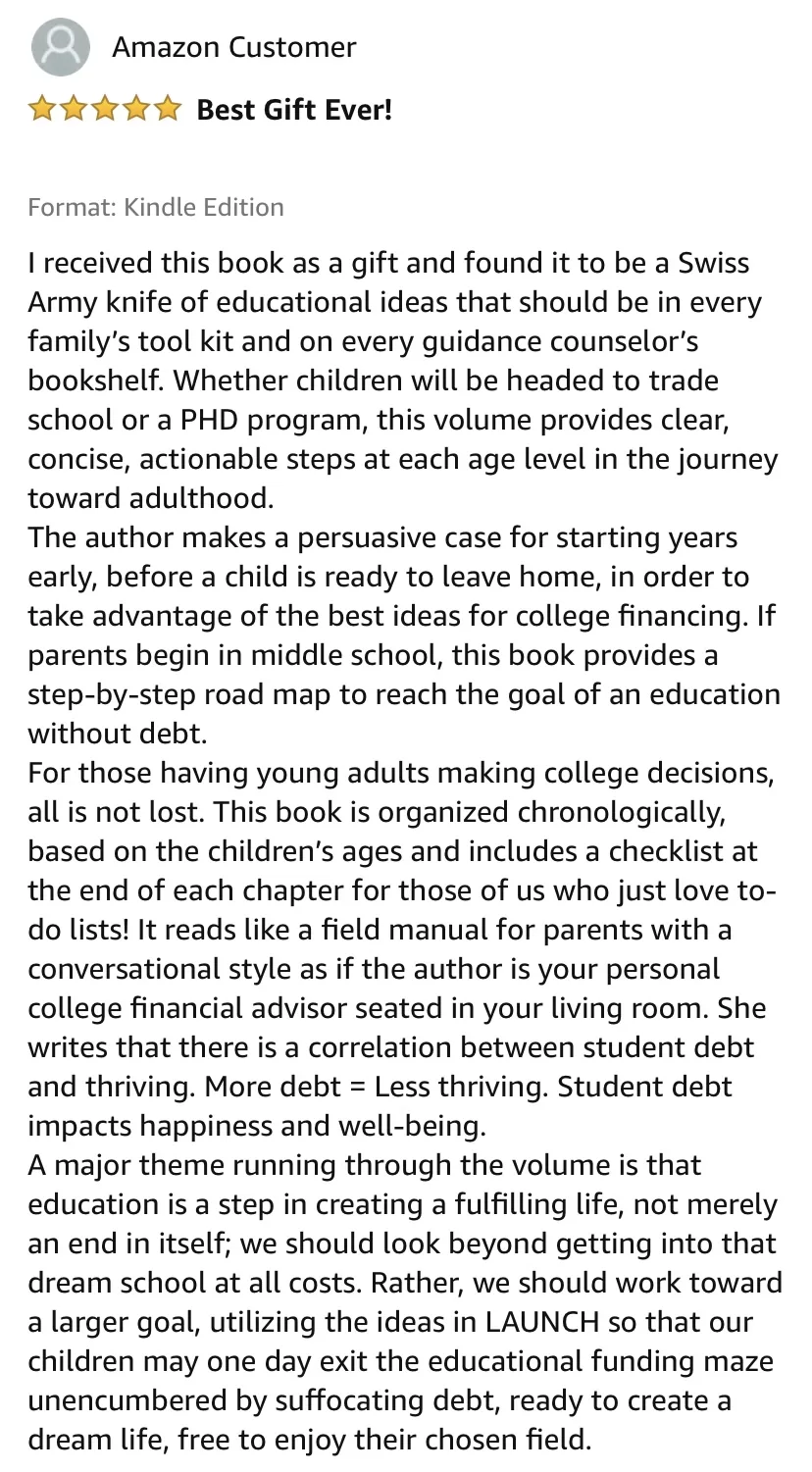

Remember, my book LAUNCH makes a truly life-changing holiday gift.

Think—who on your gift list has kids under age 18? You can buy copies right now, here.

Write this in the front of the book before giving it:

“Get free, fast-paced, 10-minute video training on how to use this book most efficiently—right at the top of JeannieBurlowski.com.”

If you’re a parent, share this article with the grandparents in your family the next time they ask, “What should we get the kids this year?”

I’m Jeannie Burlowski, and I’m the author of the book:

Important—> It’s a reference book, so nobody reads the whole thing cover to cover. Pick out what you need to read in it using the fast-paced, 10-minute video instructions here.

You can see hundreds of reviews of this book on Amazon by going to:

Read just one chapter of LAUNCH every 1–3 months while your child’s in middle school and high school, and you’ll know every viable strategy for debt-free college at exactly the right time to implement it.

And if your child’s already well past middle school? That’s OK; you can run to catch up. But the process of getting your kids through college debt-free goes more smoothly the earlier you start it—especially if you’re not planning to save up any money to pay for college.

Let's you and I walk together toward the goal of debt-free college for your kids.

We can accomplish this no matter your current income level—even if your kids never get a single scholarship.

Your first step is getting regularly scheduled, free helpful articles from me—right in your email inbox. Quick, sign up here.

Do you have very specific questions for me about debt-free college and career for your kids?

My TRIBE Members get the most direct access to me—while feeling good that the pennies per day they spend on the TRIBE help me bring debt-free college strategy to families who could never afford to pay for it. Join my TRIBE Membership waiting list here.

Who is Jeannie Burlowski?

Jeannie is a full-time academic strategist, podcast host, and sought-after speaker for students ages 12–26, their parents, and the professionals who serve them. Her writing, speaking, and podcasting help parents set their kids up to graduate college debt-free, ready to jump directly into careers they excel at and love. Her work has been featured in publications such as The Huffington Post, USA Today, Parents Magazine, and US News & World Report, as well as on CBS News.

Jeannie also helps students apply to law, medical, business, and grad school at her website GetIntoMedSchool.com. You can follow her on Bluesky @jburlowski.bsky.social.

No part of this article was written using AI.

This article was updated on November 13th, 2025.