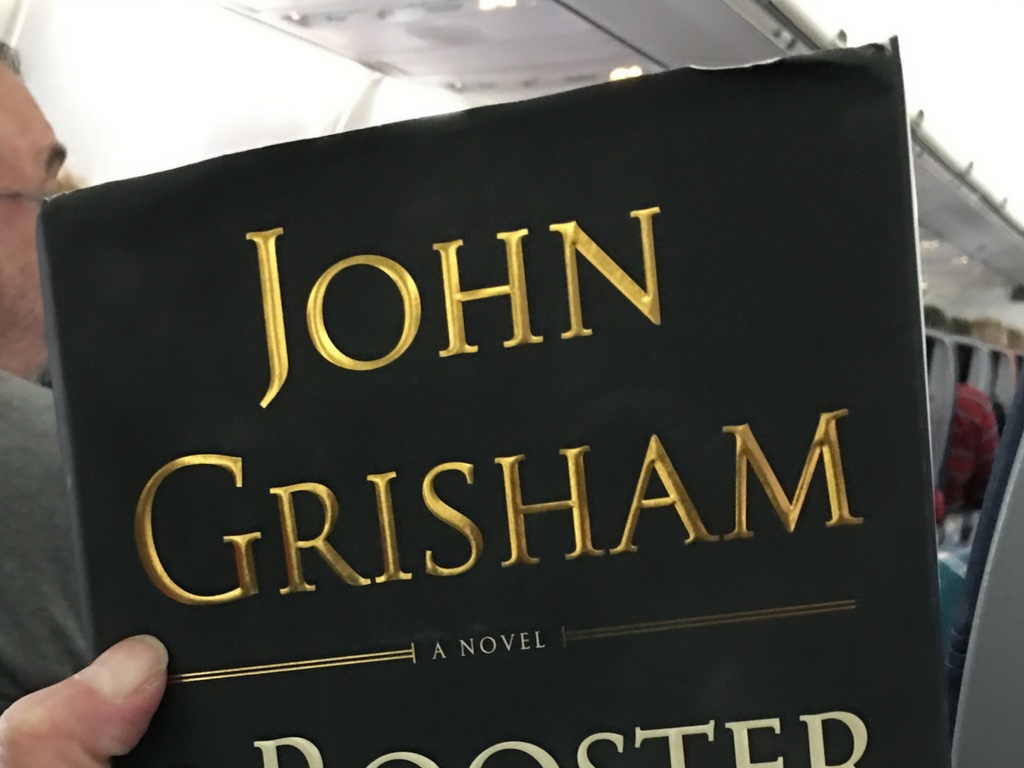

I recently read a fantastic John Grisham novel that contained a surprise for me that made my hair stand on end. What was it? The principal characters were all coping with horrific law school debt.

I’ve spent my entire professional life getting college students and grad students to careers they excel at and love with zero student loan debt. I spent years researching and writing a book on this subject. I’ve spent decades helping adults apply to law school. I can tell you, Grisham’s research on this topic is right on the money. He nails it.

BEWARE. Law school debt has the potential to destroy your kid’s life.

I am not overstating this. Students who attend law school are at a frightening risk of not being able to earn enough afterward to pay even the required minimums on their law school debt and interest. Law students from elite law schools who land the “big time” jobs will still struggle to pay—many times while working grueling 80+ hour workweeks that can feel more like indentured servitude than a great, fulfilling career.

Don’t fool yourself. It’s possible to get a great, fulfilling, high-paying professional career while avoiding law school.

On pages 133–151 of the book I wrote (and in greater depth in the second class you take inside my TRIBE Membership), I explain exactly how parents can use three career assessments to figure out what that great, fulfilling, well-paying career might be for their teen or 20-something.

Using practical career strategy early on can help your kid to avoid just blindly picking one of six careers he’s heard about on TV.

It can help her to start moving purposefully toward a career she’ll excel at and love, and toward a solid, stable financial future.

You can’t put a price on that.

If you’ve got a kid who’s considering law school, get John Grisham’s book The Rooster Bar now. Don’t wait.

Read it yourself, and then ask your child to read it.

*Note: The Rooster Bar contains adult themes not suitable for every reader. Discretion is advised.

You can read the shocking Atlantic article that inspired John Grisham to write The Rooster Bar here.

Would you like info on how to pay off student loan debt faster than most people ever do?

Check out this helpful article on LendingTree.com.

In the consulting work that is my day job, I help some students apply to law school.

But I only do so after I do these two things:

1. I make certain that the student is an ideal fit for a career that absolutely requires law school. I do all I can to prevent my clients from attending law school first and then thinking about a career plan after it’s over.

2. I strategize carefully how to get the student a real, high-quality law degree with the least possible amount of student loan debt. Here’s one way students I consult with are able to accomplish that.

These days, I spend far more time talking students out of applying to law school than I do helping them get into it.

Remember, the very best way to keep grad school debt low is to help your kids finish undergrad debt-free.

For clear, step-by-step help with this, get your copy of my book:

Important—> It’s a reference book, so nobody reads the whole thing cover to cover. Pick out what you need to read in it using the fast-paced, 10-minute video instructions here.

You can see hundreds of reviews of this book on Amazon by going to:

Read just one chapter of LAUNCH every 1–3 months while your child’s in middle school and high school, and you’ll know every viable strategy for debt-free college at exactly the right time to implement it.

And if your child’s already well past middle school? That’s OK; you can run to catch up. But the process of getting your kids through college debt-free goes more smoothly the earlier you start—especially if you’re not planning to save up any money to pay for college.

Let's you and I walk together toward the goal of debt-free college for your kids.

We can accomplish this no matter your current income level—even if your kids never get a single scholarship.

Your first step is getting regularly scheduled, free helpful articles from me—right in your email inbox. Quick, sign up here.

Do you have very specific questions for me about debt-free college and career for your kids?

My TRIBE Members get the most direct access to me—while feeling good that the pennies per day they spend on the TRIBE help me bring debt-free college strategy to families who could never afford to pay for it. Join my TRIBE Membership waiting list here. (The parent testimonials you'll see there are so encouraging!)

Who is Jeannie Burlowski?

Jeannie is a full-time academic strategist, podcast host, and sought-after speaker for students ages 12–26, their parents, and the professionals who serve them. Her writing, speaking, and podcasting help parents set their kids up to graduate college debt-free, ready to jump directly into careers they excel at and love. Her work has been featured in publications such as The Huffington Post, USA Today, Parents Magazine, and US News & World Report, as well as on CBS News.

Jeannie also helps students apply to law, medical, business, and grad school at her website GetIntoMedSchool.com. You can follow her on Bluesky @jburlowski.bsky.social.

No part of this article was written using AI.

This article was updated on January 14th, 2026.