To see a list of the top 9 questions parents are asking me about LAUNCH —along with detailed answers—scroll to the red print below.

To see a list of the top 9 questions parents are asking me about LAUNCH —along with detailed answers—scroll to the red print below.

When Morgan Stanley’s Alix Magner calls you, you sit up a little straighter in your chair.

Alix is a high-powered, Stanford-educated wealth management advisor who works with Minneapolis area families who have millions in assets—and families who are strategizing to get to that point.

When Alix told me that she’d read my book cover-to-cover and wanted to buy 30 copies for her clients, I jumped out of my chair.

Why? It’s been my hope from the beginning that financial planners would give copies of LAUNCH to their clients—along with these words: “Just follow the directions in chapter 2 of LAUNCH. Read a chapter every three months while your kids are in middle school and high school, and you’ll know every viable strategy for getting your kids through college debt-free and into jobs they love—while protecting your own retirement. I’ll be checking in with you at a number of key points along the way.” Alix is doing exactly this with the Minneapolis area clients she serves. She told me, “We have a 3-meeting schedule for our top clients, and you and your book are now officially an agenda item for Meeting #1.” If Alix Magner thinks the strategies in LAUNCH are this important, might you find them helpful and inspiring too?

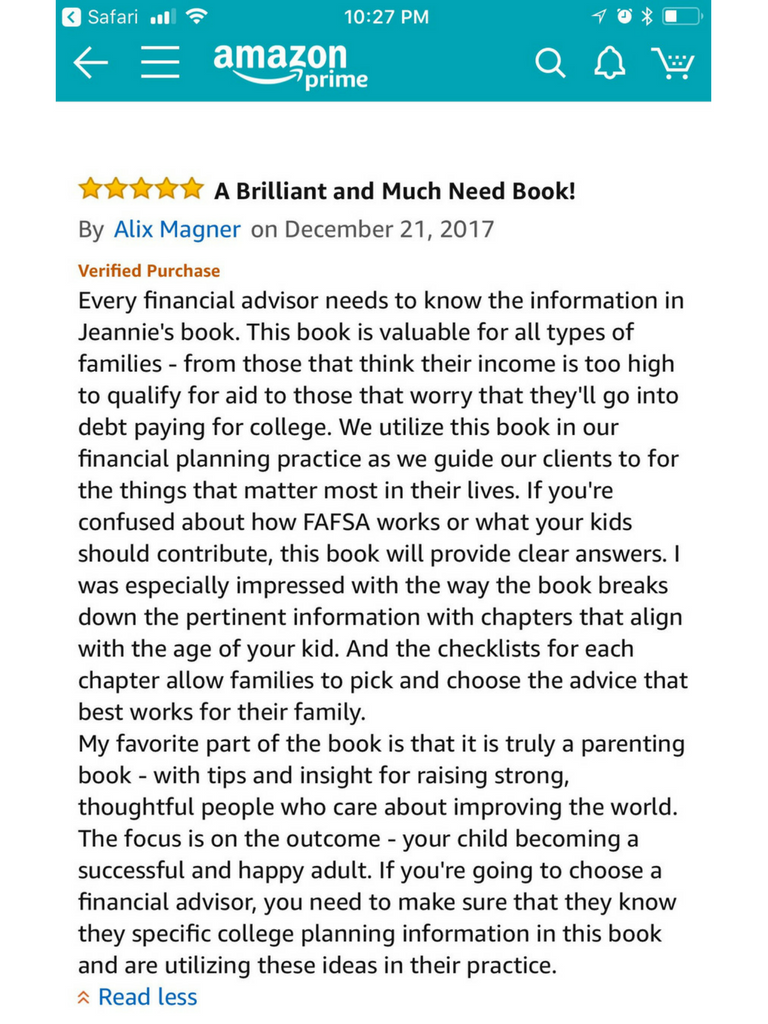

Below, see the 5-star review Alix Magner gave LAUNCH on Amazon.com.

To locate a financial planner or wealth management advisor who’s read LAUNCH cover-to-cover as Alix has, do this:

Visit my Approved Consultants tab on this website.

Top 9 Questions Parents Are Asking Me About LAUNCH

1. “Our son’s only in middle school. Surely we don’t need to be thinking about college yet!”

Did you know—that if you wait until your son’s in 11th grade to start thinking about paying for college, 75% of the best ideas for getting him through college debt-free will be gone? My book still gives you valuable help if you’re at that point right now, but to get the best possible running start, read the first four chapters of LAUNCH when your kid’s in middle school. Please tell your friends.

2. “Our daughter’s already in college. Will this book still help us?”

If your child is already in college, LAUNCH may save you thousands between now and her college graduation. Here are three things you may not know.

First, you need to be filling out the FAFSA form every October 1st that you will have a child in college the following fall. This is true even if you make $200,000 per year and are utterly convinced you will never get any help paying for college. College aid is handed out based on a wide variety of constantly shifting and interwoven factors, so if you neglect to fill out the FAFSA form, you may be leaving thousands of dollars on the table. Now, that said, wouldn’t you like to know what to do right before you fill out the FAFSA each October — to make sure you get all the free money you have coming to you? Chapter 20 of LAUNCH clearly explains this. It helps no matter what age your child is.

Second, did you know that there are safe, legal strategies you can use while filling out the FAFSA form to help your child get extra free money for college next year? Wouldn’t you like to know what those strategies are well before this coming October 1st, so you can take full advantage of them? Chapter 22 of LAUNCH will explain them all to you.

Third, did you know that you can approach your daughter’s college financial aid office and request additional help paying her college bills? The timing on this is important, though. Wouldn’t you like to know when to make this “appeal,” and what six things to say as you do so? Chapter 26 of LAUNCH explains exactly what you need to know.

Besides all this—if your daughter doesn’t yet have a career goal in mind for after she graduates for college, you should race straight to chapter 13 of LAUNCH right now. This week. Why? In chapter 13 I’ll help your family to use three well-respected career assessments to help your daughter figure out a great-fit career goal based on her natural interests, gifts, Myers-Briggs personality type, and top 5 human strengths based on Gallup research. If your daughter’s current college studies aren’t going to get her to an ideal-fit career after college, wouldn’t you like to know that now, before you spend $50,000 more on this college education?

This is important. Tell your friends.

3. “Our daughter’s in her 20’s and currently not in college. She’s not sure what she wants to do with her life. Will this book help with that?”

Please read the red paragraph above. Your under-employed daughter needs chapter 13 of LAUNCH. Even if your daughter is adverse to the idea of attending four-year college, she will find strategies in chapter 13 of LAUNCH that can get her to a great, well-paying career she loves without four-year college.

4. “We’re not saving up any money, our kid’s not getting any scholarships, and we won’t qualify for any federal financial aid. Does this book have additional ideas beyond that?”

Yes. Hundreds. Trust me.

5. I already have so many books I’m supposed to be reading. I’ll read those first, and then get to this one later.

Wait, wait — this isn’t a book you read straight through. LAUNCH is set up so you read only 1-2 chapters every three months or so while your kids are in middle school and high school. Chapters are carefully labeled so that you always know exactly which chapter specifically applies to you. This way you never feel overwhelmed, but you always learn about all the best debt-free college and career strategies at exactly the right time to implement them. The last thing you want is to find yourself, when your son is a junior, slapping your forehead and saying, “I’d give anything if I’d have just known about this sooner!” The best advice? Get LAUNCH when your child’s just starting middle school, and read it bit by bit over five or six years.

6. “What if I buy this book, and then things change? How will you update me?”

I have carefully planned for this. If you’ll subscribe to my free email newsletter here, I’ll send you a helpful, inspiring, free article on Mondays, plus—anytime anything changes, I’ll be able to update you instantly. It’s our way to stay connected as your kids grow up.

7. “When I heard you speak recently, you emphasized co-op college programs because of the large amount of targeted work experience they provide. Does LAUNCH provide more info on co-op college programs?”

Yes. Pages 161-165 explain exactly what co-op college programs are, how they can help students get stunning amounts of real-world work experience while they’re still in college, and what spectacular tax advantages co-op college programs have for parents.

8. “How can we get you as a speaker for our event?”

I travel all over the United States for speaking. I love meeting your people, and I love answering individual questions for them after I speak. And the best news? Parents willingly pay extra to hear me, so no matter what kind of event you’re planning, you will likely make money by having me in your lineup. The first step to getting me to speak is having a phone conversation with me where I hear about your organization’s needs and create a plan tailored specifically for you.

Check out what parents and students are saying about my speaking (and give a listen to what I sound like) at JeannieBurlowski.com/SPEAKING, and then email my assistant, Natalie, at Jeannie@JeannieBurlowski.com to set up your free no-obligation planning phone call.

9. I’m a grandparent. Can I use this book to help my grandchildren?

Yes! Oh, what a valuable gift you’ll be giving them if you do this. Chapter 3 of LAUNCH even includes two special things you as a grandparent can do to start amassing college savings for kids right now, without spending one penny more than you are already. Your grandkids’ parents are so busy — if you step in and provide just a little help with debt-free college planning steps now, that could end up being a blessing to your family in ways that last for generations. Get your copy of LAUNCH here.

As one very wise mom said, “If I get even one good idea out of this book, it’ll be worth it.”

For clear, step-by-step help getting kids 12 and up through college debt-free—WITHOUT SCHOLARSHIPS, get your copy of:

Important—> It’s a reference book, so nobody reads the whole thing cover to cover. Pick out what you need to read in it using the fast-paced, 10-minute video instructions here.

You can see hundreds of reviews of this book on Amazon by going to:

You can see why financial advising professionals love LAUNCH, here.

You can see the top 9 questions parents are asking me about LAUNCH, here.

Read just one chapter of LAUNCH every 1–3 months while your child’s in middle school and high school, and you’ll know every viable strategy for debt-free college at exactly the right time to implement it.

And if your child’s already well past middle school? That’s OK; you can run to catch up. But the process of getting your kids through college debt-free goes more smoothly the earlier you start it—especially if you’re not planning to save up any money to pay for college.

Let's you and I walk together toward the goal of debt-free college for your kids.

We can accomplish this no matter your current income level—even if your kids never get a single scholarship.

Your first step is getting regularly scheduled, free helpful articles from me—right in your email inbox. Quick, sign up here.

Do you have very specific questions for me about debt-free college and career for your kids?

My TRIBE Members get the most direct access to me—while feeling good that the pennies per day they spend on the TRIBE help me bring debt-free college strategy to families who could never afford to pay for it. Join my TRIBE Membership waiting list here.

Who is Jeannie Burlowski?

Jeannie is a full-time academic strategist, podcast host, and sought-after speaker for students ages 12–26, their parents, and the professionals who serve them. Her writing, speaking, and podcasting help parents set their kids up to graduate college debt-free, ready to jump directly into careers they excel at and love. Her work has been featured in publications such as The Huffington Post, USA Today, Parents Magazine, and US News & World Report, and on CBS News.

Jeannie also helps students apply to law, medical, business, and grad school at her website GetIntoMedSchool.com. You can follow her on Bluesky @jburlowski.bsky.social.

No part of this article was written using AI.

This article was updated on May 23rd, 2022.